TRACK RECORD OF SUCCESS IN OXFORD, MS

(HOME TO OLE MISS)

Oxford Reserve Phase II GP, LLC

36 Doors/12 Townhouses, 100% leased six months prior to closing

$6.2 Million Project

Closed July 18, 2025

Oxford Reserve Properties GP LLC

18 Doors/6 Townhouses – 100% Occupancy

Exceeding proforma in operations and cash on cash distributions

$3.0 million project

Closed July 2024

Oxford Way LLC

Converted short-term rental to long-term hold. Stabilized and repositioned.

$.5 million project

Closed July 2023

WHY INVEST IN

STUDENT HOUSING

Why Invest in Student Housing

1. Rapid Enrollment Growth

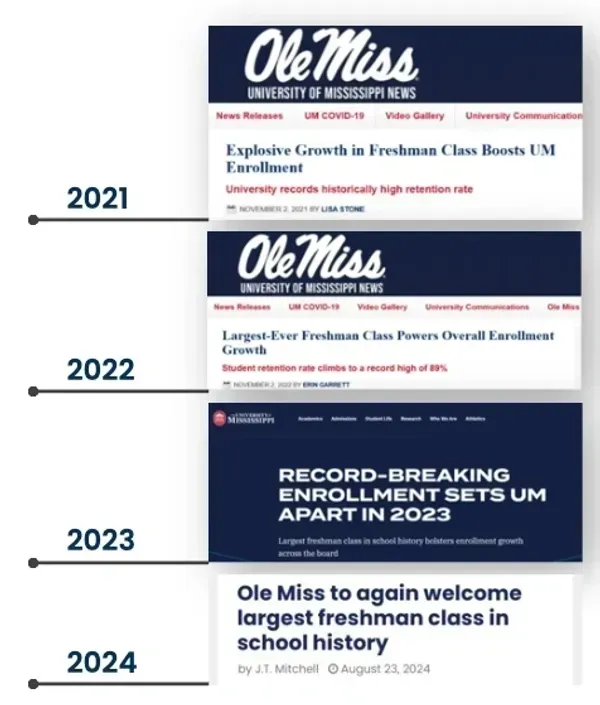

Ole Miss leads the SEC in enrollment growth over the past five years—up nearly 30% since Fall 2018, with plans to add another 5,000–6,000 students by 2030 .

Freshman classes continue to hit record highs, indicating sustained demand for nearby housing.

2. Strong Demand / Limited Supply

Off-campus student housing demand exceeds supply, with existing properties at or near 100% occupancy or pre-leased ahead of time.

Preleasing for Fall 2025 is already at 99.8%, well above the national average of 72.7%.

On-the-ground feedback from students confirms the challenges: “Rental market here def sucks… Oxford has an affordable housing crisis.”

“Apartment rents are skyrocketing… landlords know they have a captive audience.”

3. Major Institutional & Private Developments

Ole Miss is expanding housing via a public-private partnership with Greystar—creating approximately 2,700 new beds on campus, with occupancy expected by 2027.

GTIS Partners and RISE are developing 504-bed premium housing (216 units) one mile from campus, opening for the 2026–27 academic year.

Morgan Stanley and The Scion Group are acquiring a ~$262M student housing portfolio (~600 units, 2,000+ beds) to meet growing demand.

4. Oxford’s Strategic Location & Growth Potential

Oxford is only 70 miles from Memphis International Airport, making it attractive for students and investors alike.

Lafayette County (where Oxford is located) is projected to grow by 31.6% from 2020 to 2040, further boosting long-term housing demand.

Oxford’s student housing market benefits from a powerful combination: strong and growing demand, under-supplied inventory, strategic new development, and long-term regional growth. That makes it a compelling option for investors seeking stable occupancy, resilient cash flow, and upside potential.

Why Invest in Collegiate Capital LLC

Specialized Focus: Collegiate Capital is a private equity firm focused exclusively on premium, off-campus student housing in SEC college towns with strong enrollment and limited supply—starting with Oxford, MS (Ole Miss).

Strong Market Fit: Their current projects are in Oxford—recently named USA Today’s “Best Small College Town in America”—where properties regularly lease up nearly a year in advance.

End-to-End Control: Collegiate Capital acquires off-market or pre-construction properties directly from developers, and provides full-service management from acquisition to leasing and ongoing operations.

Trusted Track Record & Investor Experience: Led by a seasoned CPA, the firm uses rigorous underwriting and a vertically integrated model. This investor-first approach—emphasizing transparency and professional execution—has garnered a strong base of repeat investors.

Mission-Driven Approach: Collegiate Capital isn’t just about returns—they aim to create environments where students thrive and parents feel reassured, while delivering risk-adjusted returns for investors.

About Michelle Goheen, CPA

Deep Financial Expertise: Michelle brings over 30 years as a CPA, including a decade with EY and PwC, where she handled IPOs, M&A, and divestitures worth tens of billions of dollars.

Longstanding Real Estate Investor: Having invested in real estate since 1994, Michelle applies her strategic finance and risk-management skills to student housing syndications—especially in high-demand markets like Oxford, MS.

Tax Strategy Leader: She leverages 1031 exchanges, cost segregation, and self-directed IRAs to drive tax-efficient investment strategies that increase investor returns. She also co-founded the Real Estate Tax Strategy Institute to share those insight.

Local Market Expertise: Based in Oxford, Michelle brings extensive on-the-ground relationships with brokers, developers, bankers, attorneys, and property managers—giving her early access and tight control over project execution

Why We Love Investing in OXFORD, MS

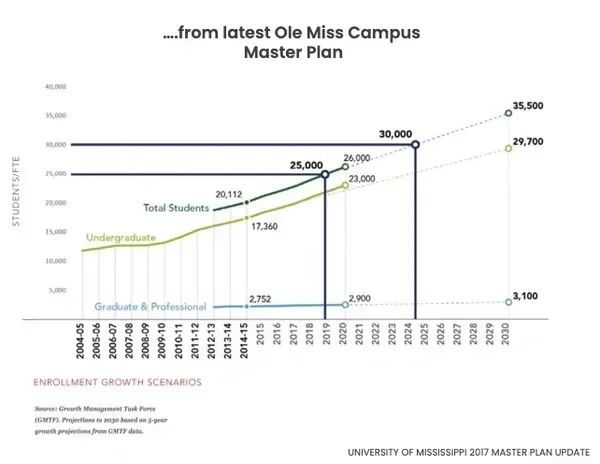

ENROLLMENT PROJECTED TO GROW 30% BY 2030

Enrollment at Ole Miss projected to increase over 30% by 2030. (+~6,000 students).

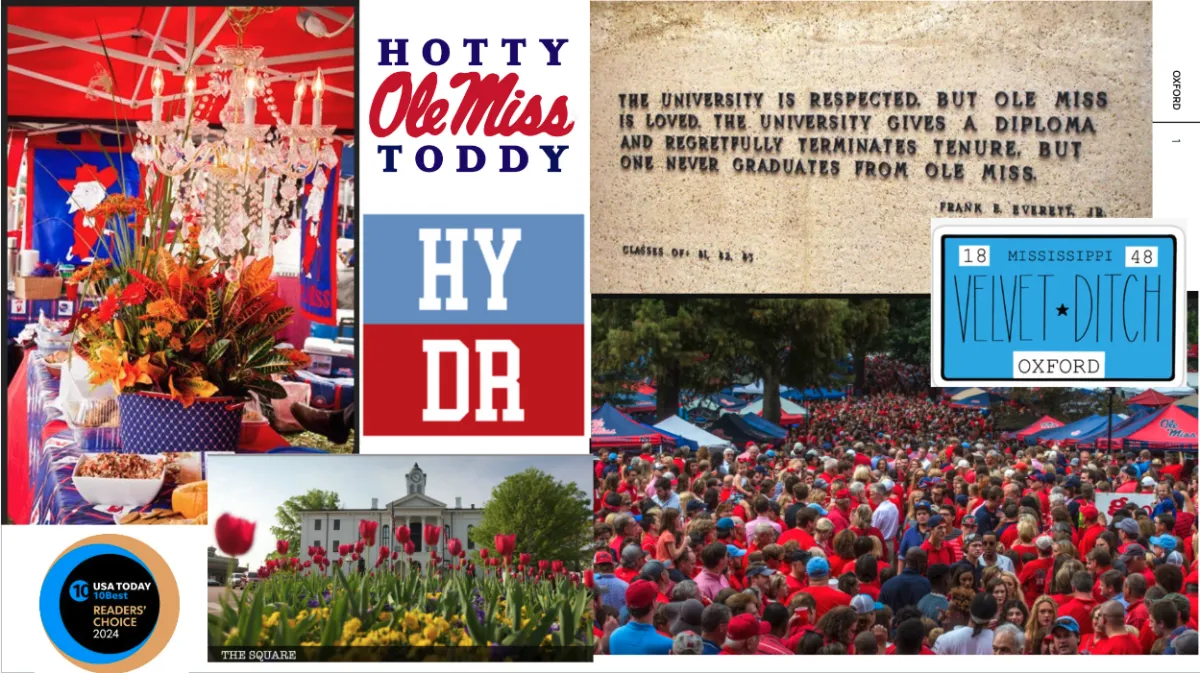

Nationally Recognized Appeal

Oxford was voted Best Small College Town in America by USA Today — a nod to its vibrant culture, charm, and unmatched school spirit.

Consistent Demand

Home to Ole Miss, Oxford draws a steady flow of students, families, alumni, faculty, and visitors — keeping housing demand resilient year-round.

SEC Fan Base + Game Day Economy

The SEC effect is real: game weekends, alumni events, and tailgates drive major tourism and recurring short-term housing needs.

Tight Housing Market

Limited inventory and zoning restrictions make well-located rentals scarce and valuable, especially outside of student housing.

Easy Access, Elevated Experience

With a private airport and growing interest from corporate, legal, and university travel, Oxford offers access with exclusivity — ideal for high-quality, long-term rental models.

University Anchor

Ole Miss isn’t just a college — it's an economic and cultural anchor for the town, fueling ongoing infrastructure, talent, and investment stability.

Smart Growth, Not Sprawl

Oxford’s growth has been intentional, not chaotic, preserving its charm while creating opportunity for investors with the right product-market fit.

Strong Emotional Ties

Whether it’s a family legacy, a gameday tradition, or alumni pride — people return to Oxford. And when people return, they rent.

LOCATION

HIGHLIGHTS

Oxford is 70 miles south of Memphis International Airport.

Off-Campus Student Housing Demand

University of Mississippi – 2,900 full-time/700 part-time

Baptist Memorial Hospital – 1,200 employees

RETAIL & SHOPPING

The Historic Oxford Square – 5 minutes away

All Oxford grocery stores, restaurants, banking and consumer goods within 10-minute drive.

SCHOOLS, PARKS & RECREATION

Ole Miss ~ 6-minutes, all Oxford schools all <10 min

South Campus Hiking and Biking “Rail Trail” – <5 minutes

20 minutes to Sardis Lake public use area

OXFORD STUDENT HOUSING

DEMAND > SUPPLY

Off-Campus Student Housing Demand

99.9% Occupied in 2023/2024

Supply Not Keeping Up

Record breaking freshmen classes 2021-2024

5 off-campus apartment complexes are master leased by University for incoming Freshman Housing for ‘24/’25

200% increase in short-term rentals (previous long-term rentals converted)

Non-student population increased 3,500 since 2020

In 2024, most other new construction is 2-3x distance to Ole Miss and Square

Mississippi Population Growth:

Know Where It's Headed

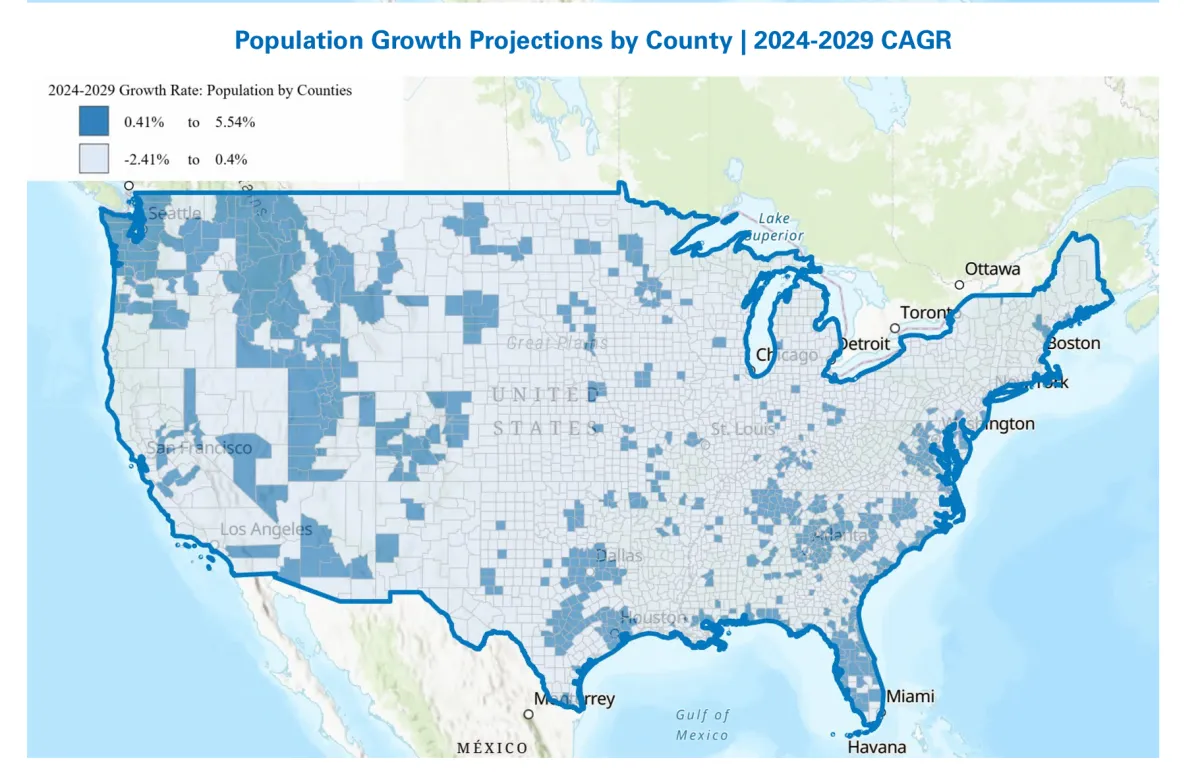

At Collegiate Capital, data drives our strategy — and these population projections are too important to ignore.

🏆 Lafayette County (Home of Oxford) is projected to grow by 31.6% from 2020 to 2040 — one of the fastest-growing counties in Mississippi.

Why does this matter?

➡️ More people = more housing demand

➡️ More students = higher occupancy rates

➡️ Smart investment = long-term returns

We're not just following the trends. We’re investing where growth is

projected, not just where it’s popular.

📍 Oxford isn’t just a college town — it’s a growth engine.

Collegiate Capital is actively investing in off-campus student housing across high-growth SEC college towns, with a primary focus on Oxford, MS—home of Ole Miss, the University of Mississippi.

Read more about Ole Miss!

Sorry, Harvard. Everyone Wants to Go to College in the South Now.

Northeast students are heading south for college

Why the university doesn’t ‘just accept fewer students’

Morgan Stanley, Scion to Pay $262M for Student Housing Portfolio

Scholarly retreats: 10 best small college towns in the US

University Breaks Overall Enrollment Record

This Is the Best College Campus in the U.S., According to New Report

The Top Small US Cities for Food and Drink

25 Best College Towns and Cities in the U.S.

Highlights From Oxford, MS

CONTACT US TO GET a COPY OF THE OFFERING MEMORANDUM

Collegiate Capital, LLC

Copyright © 2024 Collegiate Capital LLC - All Rights Reserved.

Collegiate Capital does not offer or solicit the sale of securities or other investments through this website or any other communication. All investment opportunities offered by Collegiate Capital are made solely through a private placement memorandum, which is provided only to accredited investors in compliance with applicable securities laws and regulations. Investments involve risk, and past performance is not indicative of future results. Prospective investors are urged to review all offering materials carefully and consult with their financial, tax, and legal advisors before making any investment decision.

Facebook

LinkedIn